While almost all cruise vessels continue to be built in Europe, the focus of the industry is shifting decidedly east. Will shipyards move with it? Colin Castle talks to PFJ Maritime Consulting’s Raoul Jack, and Reinhard Luken, managing director of the Verband für Schiffbau und Meerestechnik (German Shipbuilding and Ocean Industries Association), to find out whether Beijing’s new ambitions can compensate for its competitive disadvantages.

When the World Dream was launched in October 2017, it was the third ship that year to be specially built in Europe for the Chinese market. Norwegian Joy had come in April and, in July, Majestic Princess – complete with karaoke, mahjong and a gaming area – made the same journey from a Western shipyard to an Eastern market.

It’s not only special-built ships that have made the long journey to China to serve what is one of the cruise industry’s fastest-growing markets; Quantum of the Seas and Ovation of the Seas have been specially refitted for new clients in East Asia.

The sheer number of these new customers, too, makes it clear why operators are putting in the extra hours. The China National Tourism Administration estimates that 4.5 million Chinese passengers will be cruising by 2020 – a figure that is predicted to almost double by 2030. Given enough time, more Chinese citizens are projected to take cruise holidays than any other nationality on earth. So why do ships continue to be built in Europe?

New competitor

“This is mainly down to lack of knowhow, design capability and supply chain,” explains Raoul Jack, principal consultant at PFJ Maritime Consulting.

In an ideal world, workers could simply be employed by the rapidly growing shipyards in the East, but it’s not as simple as all that. “Due to the workload of European shipyards, every skilled worker is needed, and premiums are being paid to retain them,” explains Jack. “This also applies to design capabilities.”

Even so, Beijing has set its sights on competing with the big players in Europe. The China State Shipbuilding Corporation (CSSC), the country’s largest shipping conglomerate, has been ordered to take the lead on this national project.

China wouldn’t be the first East Asian nation to try and beat European yards at their own game. South Korea’s shipbuilding woes, for example, are well documented. Daewoo Shipbuilding & Marine Engineering, one of the country’s largest, almost faced total bankruptcy last year, and its chaebol-linked competitors have hardly had an easier time, racking up billions in losses not unrelated to the increasingly stiff competition just across the Yellow Sea. Meanwhile in Japan, Mitsubishi Heavy Industries announced in October 2016 that it would cease a brief flirtation with assembling cruise ships, after losing $2.31 billion building two such vessels for a US operator.

Then again, neither Japan or South Korea’s shipbuilders enjoy the same level of government backing offered to their Chinese counterparts. A commitment to supporting shipyards and their work has been included in Beijing’s five-year plans since 1956. However, 2016 saw a new commitment to ‘high-tech shipbuilding’; in other words, the kind that can manufacture cruise ships.

For Reinhard Luken, managing director of the German Shipbuilding and Ocean Industries Association (VSM), this picture is not a rosy one. He describes a burgeoning competitor with money to burn, and one that’s not always interested in making sure everyone gets a fair slice of the pie. Luckily, the Europeans still have the edge for one simple reason: a legacy of engineering expertise built up over multiple generations.

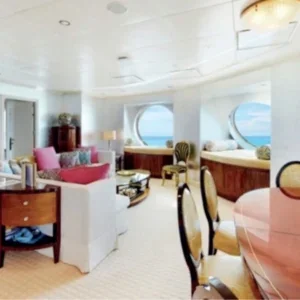

To Luken, building a cruise ship is hardly comparable with assembling a cargo vessel. “You are actually building a small town,” he says. “You are building an entertainment park, you’re building a huge hotel area. It’s not the same as a bulk area, which is basically an empty steel drum.”

And while Chinese shipyards certainly have the capacity to build steel drums, it’s not yet clear whether the clear advantage that the European market has in expertise can be overcome. It’s a competitive edge established over a long period of time, an entire value chain that comprises up to 1,000 companies working in tandem. Each has to perform perfectly on time, be reliable and meet the expected quality standards. Bringing together all of these specialised professionals from so many different – and often small – companies is not simple.

“That’s also what makes it difficult to copy,” says Luken. “But of course, when money doesn’t matter, there are a lot of things you can do. If you have a state objective, then the war chest is deep. I think we have no reason to believe that they won’t deliver on those goals, and that it will be nearly impossible to do without significant support by the government.”

Challenges to becoming a leader

Despite its grand plans, Jack says that the Chinese market faces two main obstacles: inexperience in ship design and managing its supply chain. To mitigate the former, European players are coming in to fill the gap: for example, CSSC has partnered with Italy’s Fincantieri.

“They are using a proven design that has vessels already in operation,” he adds.

However, European players that are active in the Chinese market have faced institutional challenges. Luken states that many partners say the business environment in China is getting more difficult – and at a time when cooperation is essential.

“We are not developing in a more equal or reciprocal situation, but we are seeing a trend where things are getting more difficult for Europeans,” he says, pointing to local pressure that is placed on everything from the admission of ruling party members into corporate leadership to the need for Western businesses to enjoy secure online communication.

“You’re not totally free, you cannot take out surplus and invest it somewhere else. It has to stay in the country,” he explains. “I think the business conditions for foreigners in China are developing in the wrong direction.”

Much of this also comes down to mindset. The problem, Luken says, is that the Chinese state and its enterprises invariably seek “win-win” results. This is fine, and is profitable for all parties when implemented properly, but the outcome is often not beneficial for everyone. “It must be ‘win-win’ over time and sustainable. If it’s a short-lived ‘win-win’ and then one partner loses out, that’s not good,” he says. “That’s not the foundation on which such partnerships can grow.”

Jack also states that this strong state can also step in to help domestic builders overcome their other disadvantages. “China is also promoting the development of the supply chain through local government support,” he explains. “Many of the main subcontractors are setting up operations through joint ventures and partnerships in China. Also, as cruise ship orders are placed, the finance becomes readily available to further develop the supply chain.”

Market forces

Much of the reason why the cruise industry is so enamoured with China comes down to its similarities with the world’s biggest market: the US. “In the US, people are taking fairly short holidays and the cruise product is fantastic for that, because you get so much,” says Luken. “That’s what’s why it’s logical that the cruise industry is looking with great excitement to China.”

On the other hand, there are lessons to be learned from the cargo ship business, where oversupply driven by a strong expansion of production capacity has led to a massive oversaturation of the market, and a lot of people losing a lot of money.

“We need to make sure this doesn’t happen for the niche markets, which are still quite healthy, and we don’t want to destroy them,” says Luken. “Market forces usually prevent this type of irrational oversupply, if you factor in your costs. But if you have government programmes that allow you to ignore market forces, then this distorted factor will have negative consequences.”

These market forces could also help European shipbuilders stay ahead of the new Chinese competitors, as the sheer demand for cruises is set to outpace the rate at which they can be built for the next decade. “For the next 15 years at least, there is room for European and Asian shipbuilders to maintain healthy order books due to the demand for cruising outweighing supply,” says Jack.

Ultimately, Luken argues, there needs to be a discussion with the Chinese, not only on how these competing demands can be resolved, but also what both sides will do to harness their strengths and push ahead together. He adds that there must be a middle ground between balancing the expertise of the European shipbuilders with the capacity – and the deep pockets – of the Chinese.

“I think we can discuss with them that it makes no sense to burn too much, but to discuss how this can rationally developed,” Luken says. And if they can’t be convinced, is it realistic to assume that Asia is ready to take up the mantle of building cruise ships in the next few years?

“Without a doubt, Asia is ready,” Jack says. “I would be more specific and claim that China is ready.”